April 4, 2025

Mortgage rates in the United States have seen a slight decrease, offering potential relief to prospective homebuyers amid ongoing economic fluctuations. As of April 3, 2025, the average interest rate for a 30-year fixed-rate mortgage stands at approximately 6.778%, reflecting a minor decline from previous weeks.

Current Mortgage Rate Trends

- 30-Year Fixed-Rate Mortgages: The national average rate is approximately 6.778%, showing a slight decrease.

- 15-Year Fixed-Rate Mortgages: The average rate is around 6.148%, marking a modest decline.

- 5/1 Adjustable-Rate Mortgages (ARMs): Rates are averaging about 5.98%, indicating a decrease of 10 basis points over the past week.

Factors Influencing Mortgage Rates

Several elements are contributing to the current mortgage rate environment:

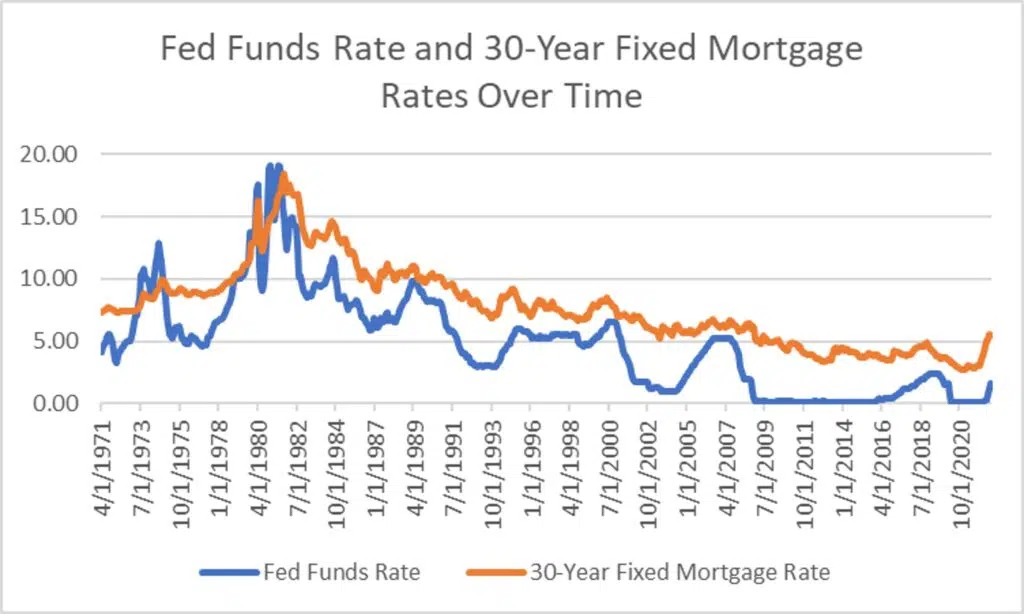

- Federal Reserve Policies: The Federal Reserve’s decision to maintain the federal funds rate within the range of 4.25% to 4.5%, with potential rate cuts hinted at for later in the year, influences borrowing costs across the economy.

- Economic Indicators: Indicators such as inflation rates, employment figures, and GDP growth impact investor sentiment and, consequently, mortgage rates.

- Global Trade Dynamics: Recent tariff implementations have introduced economic uncertainties, leading investors to seek safe-haven assets like U.S. Treasury bonds, which can affect mortgage rates.

Impact on the Housing Market

The modest decline in mortgage rates may provide some relief to homebuyers facing affordability challenges due to elevated home prices and previous rate increases. However, the overall impact on the housing market remains complex:

- Home Prices: Certain regions, particularly in the Northeast and Midwest, continue to experience rising home prices due to limited inventory and sustained demand.

- Buyer Activity: While lower mortgage rates can stimulate buyer interest, economic uncertainties and potential recession fears may temper purchasing decisions.

Expert Insights

Economists emphasize the importance of monitoring broader economic trends and personal financial readiness when considering home purchases in the current environment. While lower mortgage rates can enhance affordability, factors such as job stability, long-term financial goals, and regional market conditions should guide decision-making.